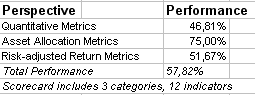

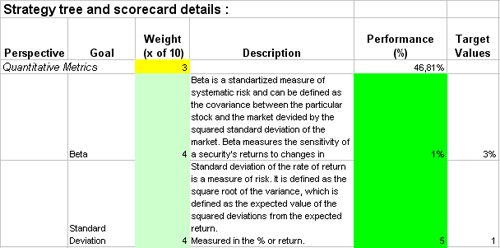

This Balanced Scorecard is designed to measure the performance of funds under the active portfolio management approach. It consists of the quantitative metrics, asset allocation metrics, and risk-adjusted return metrics that allow us to measure the performance of the portfolio with risk adjusted metrics opposite to the absolute return, used in passive management approach. The appropriate choice of the performance measure mostly depends on the role of the portfolio under question that can vary significantly. Thus it can represent the whole investment fund or its fracture, or a sub-portfolio of many portfolios.

This Balanced Scorecard is designed to measure the performance of funds under the active portfolio management approach. It consists of the quantitative metrics, asset allocation metrics, and risk-adjusted return metrics that allow us to measure the performance of the portfolio with risk adjusted metrics opposite to the absolute return, used in passive management approach. The appropriate choice of the performance measure mostly depends on the role of the portfolio under question that can vary significantly. Thus it can represent the whole investment fund or its fracture, or a sub-portfolio of many portfolios.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

An Active Portfolio manager differs from that of passive portfolio's due to the fact that former uses both economic and financial indicators for making predictions about the market. Moving to the definition of a passive portfolio, it is the one that has 'diversification of its components' as the strongest pillar giving it the support.

An active portfolio investment is carried out with the purpose of surpassing an investment benchmark index whereas no such aim exists in passive portfolio management. To achieve this, an active portfolio scorecard is often used to answer the 'tracking issues'.

Consequently, active portfolio approach is believed to provide greater returns than the passive one due to the underlying active portfolio strategy.

Due to the basic principle that makes up the 'background' of an active portfolio, it is needed that the active portfolio management be done with a good understanding about both the categories of information, that which is 'available' and the one that is to be 'forecasted'.

An active portfolio coach benefits by exploiting the inefficiencies of the market. This is to say that the person buys 'undervalued' securities and short sells 'overvalued ones'. Either of the methods or an appropriate combination of these can be employed by the manager. One of the factors that determines the mix of the two approaches is the 'level of volatility' demanded by the portfolio holder.

This is the actual scorecard with Active Portfolio Management Performance Indicators and performance indicators. The performance indicators include: active portfolio management, quantitative metrics, beta, standard deviation, nonsystematic risk, r-square, asset allocation metrics, average return, impact of asset allocation, risk-adjusted return metrics, sharpe-s measure, m-sqared measure, jensen-s alpha, treynor measure, t-squared measure, appraisal (information) ratio.

Download a trial version of Active Portfolio Management Evaluation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."