The number of customers willing to pay for accepted products and services online is increasing every year. Therefore it is important for an organization to use online credit card payment solution along with traditional merchant accounts. It has been proven that businesses that except credit card payments typically have higher sales than those that do not accept credit cards. It also helps organizations establish a professional image and generate a feeling of trust among potential customers. Most businesses take advantage of a third party credit card processor, providing real-time processing capabilities, online virtual terminals for entering manual transactions, as well as the ability to set up recurring billing.

The number of customers willing to pay for accepted products and services online is increasing every year. Therefore it is important for an organization to use online credit card payment solution along with traditional merchant accounts. It has been proven that businesses that except credit card payments typically have higher sales than those that do not accept credit cards. It also helps organizations establish a professional image and generate a feeling of trust among potential customers. Most businesses take advantage of a third party credit card processor, providing real-time processing capabilities, online virtual terminals for entering manual transactions, as well as the ability to set up recurring billing.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

It would not be an exaggeration to call 'credit card processing' a rage these days. This payment option is advantageous for both the payers and chargers as significant time and cost savings occur in the process. Besides this, the fact that a given organization accepts credit card usage portrays a professional impression about the company.

Owing to the advantages brought by this payment mode, it is being accepted with all the interest by companies. A combination of merchant accounts along with credit card transactions' option is employed by organizations to facilitate the payments issues.

However, the area of credit card payments is a technology intensive field as functioning in an electronic area demands flawless back-ground construction studded with sophisticated, and often complicated network devices and tools. This is because 'a click here or a click there' can open a can of worms for the management team.

Therefore, this virtual world of electronic card payment has to be tackled in its own manner.

A balanced scorecard to gauge the processes that occur in the way of this plastic money usage is an efficient way to keep track of how the operations have been occurring.

One can pen down the indicators relating to equipments and services used in the process and be assured of the wellness of the complete procedure.

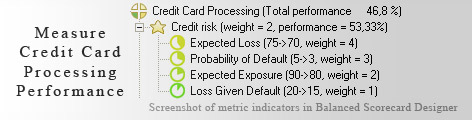

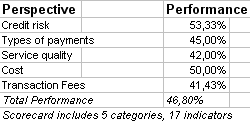

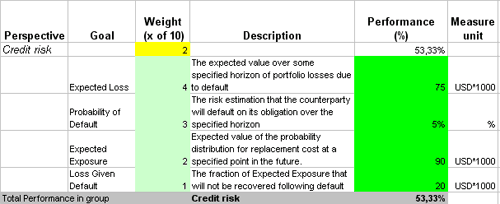

This is the actual scorecard with Credit Card Processing Performance Indicators and performance indicators. The performance indicators include: credit card processing, credit risk, expected loss, probability of default, expected exposure, loss given default, types of payments, web portal, mobile device, post mail/ phone order, retail store, service quality, average approval rating, account setup time, customer satisfaction, cost, startup cost, avg. cost per month, statement fee, transaction fees, average discount rate, transaction fee, address verification fee .

Download a trial version of Credit Card Processing Evaluation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."