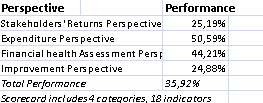

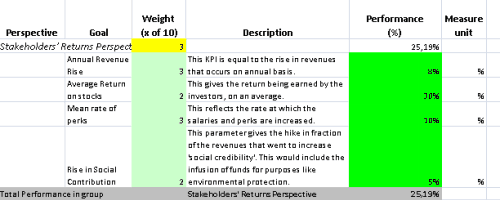

Applying the basics of benchmarking to financial aspects of the company helps it in digging the opportunities that earlier were not visible. The minute details emphasized to be followed in this approach are helpful in lifting the monetary returns of the company. The aspects, whose measurement can be useful are- Stakeholders' Returns, Expenditure, Improvement and Financial Health Assessment. Stakeholders' Returns can be measured using indicators- Annual Revenue Rise, Average Return on stocks, Mean rate of Perks and Rise in Social Contribution. This group of KPIs takes care of the interests of stakeholders. Expenditure can be calculated via parameters such as- Salary and Benefits Expenditure, Operational Expenses, Recruitment and Training Costs and Capital Expenses: Revenues. Financial Health Assessment can be had with parameters like Current ratio, Inventory Turnover, Dividend Yield Increase Rate and Debt: Equity ratio.Lastly, one can analyze the improvement gained via the 'increase in recognition', '% rise in EPS', '% increase in surplus funds' and 'drop in instances of mismatch between sources and application of funds'.

Applying the basics of benchmarking to financial aspects of the company helps it in digging the opportunities that earlier were not visible. The minute details emphasized to be followed in this approach are helpful in lifting the monetary returns of the company. The aspects, whose measurement can be useful are- Stakeholders' Returns, Expenditure, Improvement and Financial Health Assessment. Stakeholders' Returns can be measured using indicators- Annual Revenue Rise, Average Return on stocks, Mean rate of Perks and Rise in Social Contribution. This group of KPIs takes care of the interests of stakeholders. Expenditure can be calculated via parameters such as- Salary and Benefits Expenditure, Operational Expenses, Recruitment and Training Costs and Capital Expenses: Revenues. Financial Health Assessment can be had with parameters like Current ratio, Inventory Turnover, Dividend Yield Increase Rate and Debt: Equity ratio.Lastly, one can analyze the improvement gained via the 'increase in recognition', '% rise in EPS', '% increase in surplus funds' and 'drop in instances of mismatch between sources and application of funds'.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Benchmarking is basically one of the ways to keep up with the competitors. This is needed because 'working in isolation' is not something that can help an organization sustain for long. One must/has to keep a tack of all possible things that are going in the competitors' place and keep comparing own stand with that of other survivors.

Such an act helps in 'maintaining the competitiveness in the organization'. At the end of the day, 'improvement is what industrial players strive for and benchmarking assists in doing just that'.

However, this requirement of looking own performance in the light of others' is not a one-time event. One should make it a part of regular and cyclic activities to successfully utilize the concept.

One can achieve this by bringing a financial benchmarking balanced scorecard into picture. The metrics that are thought to impact the 'competitive position' are selected and followed. Values are assigned to these, both as 'target values' and 'actual values'. Further, one can get to know about deviations well in time and measures for correction can be adopted. Ending it all, setting financial standards be giving a good look at what the other industry players are up to is a must, in case the concerned organization wishes to get ahead of others.

This is the actual scorecard with Financial Benchmarking Performance Indicators and performance indicators. The performance indicators include: stakeholders returns perspective, annual revenue rise, average return on stocks, mean rate of perks, rise in social contribution, expenditure perspective, salary and benefits expenditure, operational expenses, recruitment and training costs: revenue, capital expenses: revenue, financial health assessment perspective, current ratio, inventory turnover, dividend yield increase rate, payout ratio, stock price: net current asset value per share, debt: equity ratio, improvement perspective, increase in recognition, % rise in eps, % increase in surplus funds, drop in instances of mismatch between sources and application of funds.

Download a trial version of Financial Benchmarking Estimation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."