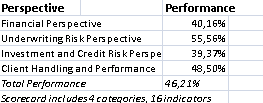

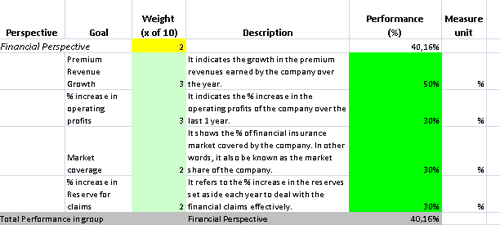

Financial Insurance Company caters to the needs of individuals and organizations which deal with high risk business activities. The aim is to develop such financial products so as to transfer the underlying risk of the customers.In financial insurance company, KPIs can be configured under four perspectives- Financial, Underwriting Risk, Investment and Credit Risk and, Client Handling and Performance.Financial Perspective provides an insight of the financial performance of the company. It takes into consideration KPIs such as premium revenue growth, % increase in operating profits, market coverage and % increase in reserves for claims.Underwriting Risk Perspective deals with management of underwriting risk associated with activities. KPIs in the form of ratio, reserve adequacy level, retention ratio and % of policies for which loss assessment modeling is done are the parts of this perspective.Investment and Credit Risk Perspective comprises of KPIs like % increase in investment returns, investment leverage, insurance duration and liquidity level.Client Handling and Performance Perspective judges the company in terms of managing customer relationship. It consists of KPIs like frequency of customer complaints, % of service level agreements monitored, number of insurance programs offered.

Financial Insurance Company caters to the needs of individuals and organizations which deal with high risk business activities. The aim is to develop such financial products so as to transfer the underlying risk of the customers.In financial insurance company, KPIs can be configured under four perspectives- Financial, Underwriting Risk, Investment and Credit Risk and, Client Handling and Performance.Financial Perspective provides an insight of the financial performance of the company. It takes into consideration KPIs such as premium revenue growth, % increase in operating profits, market coverage and % increase in reserves for claims.Underwriting Risk Perspective deals with management of underwriting risk associated with activities. KPIs in the form of ratio, reserve adequacy level, retention ratio and % of policies for which loss assessment modeling is done are the parts of this perspective.Investment and Credit Risk Perspective comprises of KPIs like % increase in investment returns, investment leverage, insurance duration and liquidity level.Client Handling and Performance Perspective judges the company in terms of managing customer relationship. It consists of KPIs like frequency of customer complaints, % of service level agreements monitored, number of insurance programs offered.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Financial Insurance Company is the one that is involved in providing financial coverage to risky businesses and processes.

This is needed as the dynamicity of both 'internal' and 'external' surroundings can fall heavy on financial standing of the organization. In such a scenario, providing economic coverage is a must.

One can avail to such a benefit by paying premiums on regular basis to the service provider in return for having financial assurance. Several such financial cover providers are operating in the market.

Heading further, ensuring that the operations are done in a well- enough manner, one requires a 'performance management tool' to measure and track the performance path. A 1990s management strategy called BSC (Balanced Scorecard) has often been used for this purpose. It rests on the basic principle that 'only when you can count your steps that you can improve those'. In other words, by framing KPIs (Key Performance Indicators) that can accurately reflect the factors having a bearing on the growth of the company, it is possible to improve the process.

This tool can also be put to use in case of economic assurance sector where an appropriate set of indicators is all that it takes to gauge the progress.

This is the actual scorecard with Financial Insurance Company Measures and performance indicators. The performance indicators include: financial perspective, premium revenue growth, % increase in operating profits, market coverage, % increase in reserve for claims, underwriting risk perspective, expense ratio, reserve adequacy level, retention ratio/ reinsurance ratio, % of policies for which loss assessment modeling is done, investment and credit risk perspective, % increase in investment returns, investment leverage, insurance duration, liquidity level, client handling and performance, frequency of complaints, % of service level agreements monitored, number of insurance programs offered, number of consulting and risk management services offered.

Download a trial version of Financial Insurance Company Evaluation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."