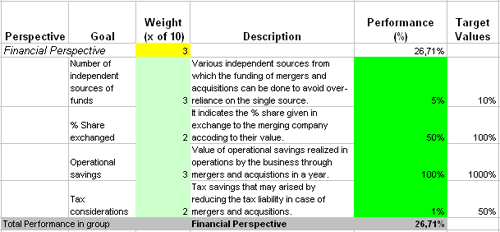

The field of Crisis management has gained utmost importance since the day of its evolution. In this era of mergers and acquisitions, crisis management can aid the business to be proactive in effectively analyzing and overcoming the potential organizational crises. KPIs can be used to encounter multitudinous issues that an organization can face in the event of mergers and acquisitions.These KPIs are basically quantified under 4 major heads- financial perspective, human resource issues, operations and partner compatibility.Financial perspective consists of KPIs like independent sources of funds, percentage share exchanged, operational savings and tax considerations. Through this perspective the financial overview of the merger and acquisition can be taken.Human resources issues are the employee related measures taken by the business to avoid crisis in the future. This perspective may include cross cultural training, clearly defined goals, operational and technical training sessions and percentage job loss.Operations perspective means the issues related to business operations to be tackled effectively by the management. It takes into consideration product continuation, product restructuring, integrated activities and percentage increase in market share.Partner compatibility talks about the different compatibilities of the businesses that must match for the success of merger and acquisition. This perspective takes into account KPIs like goals compatibility, proposed time duration, number of compliance required and pay-back period.

The field of Crisis management has gained utmost importance since the day of its evolution. In this era of mergers and acquisitions, crisis management can aid the business to be proactive in effectively analyzing and overcoming the potential organizational crises. KPIs can be used to encounter multitudinous issues that an organization can face in the event of mergers and acquisitions.These KPIs are basically quantified under 4 major heads- financial perspective, human resource issues, operations and partner compatibility.Financial perspective consists of KPIs like independent sources of funds, percentage share exchanged, operational savings and tax considerations. Through this perspective the financial overview of the merger and acquisition can be taken.Human resources issues are the employee related measures taken by the business to avoid crisis in the future. This perspective may include cross cultural training, clearly defined goals, operational and technical training sessions and percentage job loss.Operations perspective means the issues related to business operations to be tackled effectively by the management. It takes into consideration product continuation, product restructuring, integrated activities and percentage increase in market share.Partner compatibility talks about the different compatibilities of the businesses that must match for the success of merger and acquisition. This perspective takes into account KPIs like goals compatibility, proposed time duration, number of compliance required and pay-back period.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Mergers & Acquisitions are decisions that demand huge investments in terms of both physical and human resources. Consequently, one needs to collect every 'seemingly important' speck of the 'firm capturing' story and conclude accordingly as to whether the activities were successfully implemented or not.

In the absence of an effective monitoring tool, things can get ugly in no time and even a firm running well earlier can find itself in troubled waters. In other words, these delicate and sensitive issues should be tackled in a quantitative manner. One such methodology that can make this possible is BSC i.e. Balanced Scorecard.

The fruitfulness of its utility is a function of the 'relevance' the metrics listed on it hold. This suggests that the user has to be cautious and well-prepared when it comes to selection of indicators. By spotting the areas, which matter in the process it is possible to come up with a useful set of indicators. Some of the fields that deserve attention in the decision of firm acquisition are- finances required, human resources integration and operations. Pre-merger screening also forms a prominent part of the choice as zeroing on a wrong target can spell the doom for all the involved parties.

However, once appropriate number of KPIs (Key Performance Indicators) has been settled for, the onus of monitoring the act buyout or takeover can be safely transferred to this management thought.

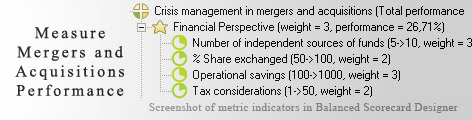

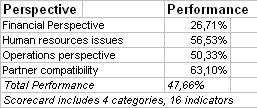

This is the actual scorecard with Mergers and Acquisitions Measures and performance indicators. The performance indicators include: crisis management in mergers and acquisitions, financial perspective, number of independent sources of funds, % share exchanged, operational savings, tax considerations, human resources issues, cross cultural training, clearly defined roles, operational and technical training sessions, % job loss, operations perspective, product continuation, product restructuring, % increase in market share, integrated activities, partner compatibility, goals compatibility, proposed time duration for merger or acquisition, number of compliance required, pay-back period .

Download a trial version of Mergers and Acquisitions Evaluation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."