Credit scores help determine the type and size of the mortgage loan for which the consumer qualifies. The score is basically a summary of the consumer's credit report, in the form of a numerical measurement that reflects his or her management of credit. Credit scores are based on the following information: consumer's payment history, the amount of credit, creditor's data, as well as any serious past problems with debts (for instance, liens, bankruptcies, collections, and judgments). The credit scoring process converts these and other factors into a single three digit number that aids in determining the likelihood the consumer will repay a loan on a timely basis.

Credit scores help determine the type and size of the mortgage loan for which the consumer qualifies. The score is basically a summary of the consumer's credit report, in the form of a numerical measurement that reflects his or her management of credit. Credit scores are based on the following information: consumer's payment history, the amount of credit, creditor's data, as well as any serious past problems with debts (for instance, liens, bankruptcies, collections, and judgments). The credit scoring process converts these and other factors into a single three digit number that aids in determining the likelihood the consumer will repay a loan on a timely basis.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Mortgage refers to the transfer of interest from the owner to the lender, as a security of debt. This interest is to go back to the owner once the debt is paid. Two basic types of mortgages instruments that are identified are- Mortgage Deed and deed of trust.

This process of providing mortgage loan is often a structured one that demands a monitoring tool to be imposed on it. Such a tracking enables a transparent conduction of the task.

The decision as to whether a given person be provided the mortgage loan or not depends to a large extent on the credit history of the individual. This credit history brings in a summarized form the 'level to which the past credit commitments were paid' by the person in question. In other words, the likelihood of receiving the debt in time can be known by looking at the previous promptness with which payments were made.

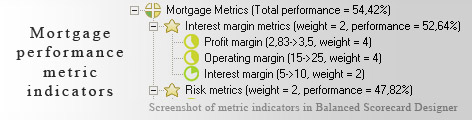

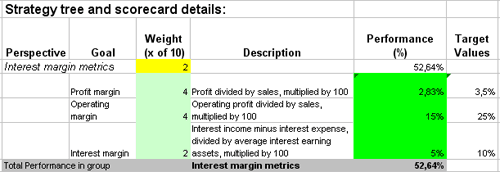

One can employ BSC (Balanced Scorecard) for this purpose. The metrics written on it should be selected after figuring out the 'factors that matter'. Once this is done, KPIs (Key Performance Indicators) that can accurately mirror the progress of Mortgage can be put together.

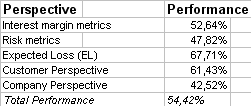

This is the actual scorecard with Mortgage Performance Indicators and performance indicators. The performance indicators include: capital adequacy ratio, distance-to-default, debt-to-income ratio (dti), annual percentage rate (apr), amortization term, loan points, company perspective, capital adequacy, gross debt service ratio (gds), customer credit quality.

Download a trial version of Mortgage Evaluation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."