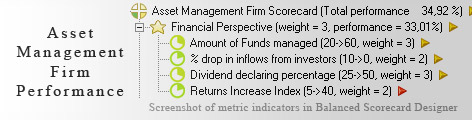

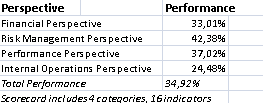

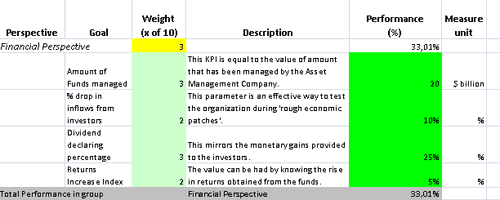

Qualitative ways of judging an organizational movements are a thing of past. Holistic measurement is the need of the hour and in this direction, several methods to evaluate a group have come up time and again. One of those that stood the test of times is BSC (Balanced Scorecard) which utilizes key performance indicators to evaluate performance. Moving on the same lines, asset management firms too have appreciated the importance of this tool and these organizations easily structure indicators to reflect their operational environment. The perspectives that count in case of these organizations are Financial, Internal Operations, Risk and Performance. Financial Perspective can be assessed by using parameters like '% drop in inflows', 'amount managed', 'dividend declaring percentage' and 'returns increase index'. Risk can be measured with 'number of security measures used', 'number of security breaches experienced', '% increase in funds given for the security issues', '% compliance with the official guidelines'. Internal Operations can be obtained with 'number of countries the organization is present in', 'number of overseas investors', 'minimum denomination needed' and 'sustenance period'. Performance Perspective can be had with 'number of awards won', 'number of cities from where the investors participate'.

Qualitative ways of judging an organizational movements are a thing of past. Holistic measurement is the need of the hour and in this direction, several methods to evaluate a group have come up time and again. One of those that stood the test of times is BSC (Balanced Scorecard) which utilizes key performance indicators to evaluate performance. Moving on the same lines, asset management firms too have appreciated the importance of this tool and these organizations easily structure indicators to reflect their operational environment. The perspectives that count in case of these organizations are Financial, Internal Operations, Risk and Performance. Financial Perspective can be assessed by using parameters like '% drop in inflows', 'amount managed', 'dividend declaring percentage' and 'returns increase index'. Risk can be measured with 'number of security measures used', 'number of security breaches experienced', '% increase in funds given for the security issues', '% compliance with the official guidelines'. Internal Operations can be obtained with 'number of countries the organization is present in', 'number of overseas investors', 'minimum denomination needed' and 'sustenance period'. Performance Perspective can be had with 'number of awards won', 'number of cities from where the investors participate'.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Asset Management refers to the professional and well-thought act of managing an investor's assets. The entities that can be put into the category of assets include shares, bonds, real estate etc and the investor can be a private investor or a firm.

The steps that comprise Wealth Management are 'financial analysis', 'selection of assets', 'selection of assets', 'implementation of plan' and 'investment monitoring'. By adopting the logical and unbiased approach towards the concept of fund management, one can draw enough fruits from the activity.

A number of companies are into investment management completely or partially and take acre of trillions of dollars and yens.

An asset management firm offers services to other organizations for better organization and coordination of assets so as to aggravate the gains from the assets' pool.

Some of the issues that creep into this subject of portfolio management are 'difficulty is maintaining the above-average performance', 'linkage of revenue to market valuations', and 'lack of experienced fund managers'. However, by structuring a well constructed path it is possible to craw the maximum from assets' bunch that is available.

This is the actual scorecard with Asset Management Firm Dashboard and performance indicators. The performance indicators include: financial perspective, amount of funds managed, % drop in inflows from investors, dividend declaring percentage, returns increase index, risk management perspective, number of security measures adopted, number of security breaches experienced in last 1 year, % increase in expenditure allocated to security issues, % compliance with regulatory norms set, performance perspective, number of schemes in global top 100, number of awards won for commendable performance, yearly % increase in the funds amount managed, fraction of funds with multiple dividends, internal operations perspective, number of countries where the firm operates, number of overseas investors., minimum denomination needed, sustenance period.

Download a trial version of Asset Management Firm Estimation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."