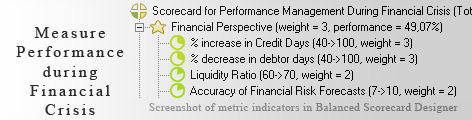

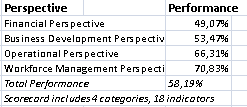

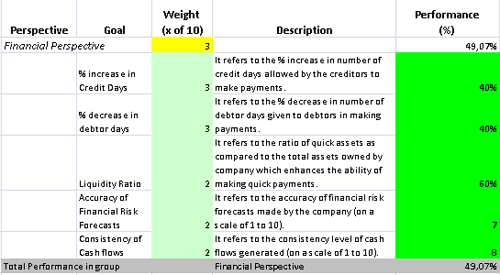

When an organization experiences a financial downturn, it has to take into consideration a variety of factors to effectively deal with the situation. The need of the time is to use a standard framework that can help in getting a holistic view of the business. KPIs arranged in a Balanced Scorecard can help the business in managing its performance during a financial crunch.KPIs in this regard can be broadly grouped under four perspectives- financial, business development, operational and workforce management.Financial Management consists of KPIs such as % increase in credit days, % decrease in debtor days, liquidity ratio, accuracy of financial risk forecasts and consistency of cash flows.Business Development Perspective takes into account KPIs like number of new long-term contracts initiated, client oriented products and services introduced, lead generation effectiveness, response level.Operational Perspective provides an insight of the operations of the business. It comprises of KPIs like % reduction in decision-making and lead time, % decrease in cycle time to resolve adjustments, simplification of lending conditions and identification of negative patterns.Workforce Management Perspective provides measures to effectively manage the workforce during financial crunch. It includes KPIs such as % decrease in staff turnover rate, training uptake, % decrease in sickness/absence Level, crisis communication and continuity of information and feedback.

When an organization experiences a financial downturn, it has to take into consideration a variety of factors to effectively deal with the situation. The need of the time is to use a standard framework that can help in getting a holistic view of the business. KPIs arranged in a Balanced Scorecard can help the business in managing its performance during a financial crunch.KPIs in this regard can be broadly grouped under four perspectives- financial, business development, operational and workforce management.Financial Management consists of KPIs such as % increase in credit days, % decrease in debtor days, liquidity ratio, accuracy of financial risk forecasts and consistency of cash flows.Business Development Perspective takes into account KPIs like number of new long-term contracts initiated, client oriented products and services introduced, lead generation effectiveness, response level.Operational Perspective provides an insight of the operations of the business. It comprises of KPIs like % reduction in decision-making and lead time, % decrease in cycle time to resolve adjustments, simplification of lending conditions and identification of negative patterns.Workforce Management Perspective provides measures to effectively manage the workforce during financial crunch. It includes KPIs such as % decrease in staff turnover rate, training uptake, % decrease in sickness/absence Level, crisis communication and continuity of information and feedback.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

History has it that messing up of financial accounts have often tainted the images and reputation earned after hard times by firms and nations. The reason can be either the deliberate manipulation of numbers or a genuine financial crisis whereby one faces acute credit shortage.

Moving on, it is well-known that finance is the lifeblood of any organization, therefore it calls for adopting every possible strategy to regulate and circulate it in effectual manner.

Due to both the inlets and outlets of funds being numerous, it becomes important to employ a potent methodology for ensuring that inflows and outflows of finances are under effective supervision. One of the ways to avoid falling into the financial trouble is keeping a constant check on the application and sources of funds. Balanced Scorecard with related indicators on it can be designed to come out of unfavorable financial situation, if any.

The economic disturbances are an unavoidable reality of industrial world. To both escape and emerge unscathed out of financial troubles, one is required to incorporate useful monitoring strategies into management and keep an eye on the processes and movements.

This is the actual scorecard with Financial Crisis Indicators and performance indicators. The performance indicators include: financial perspective, % increase in credit days, % decrease in debtor days, liquidity ratio, accuracy of financial risk forecasts, consistency of cash flows, business development perspective, number of new long-term contracts initiated, client oriented products and services introduced, lead generation effectiveness, response level, operational perspective, % reduction in decision-making and lead time, % decrease in cycle time to resolve adjustments, simplification of lending conditions, identification of negative patterns, workforce management perspective, % decrease in staff turnover rate, training uptake, % decrease in sickness/absence level, crisis communication, continuity of information and feedback.

Download a trial version of Financial Crisis Estimation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."