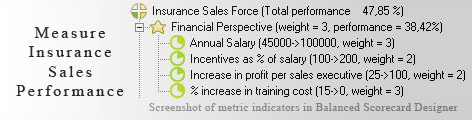

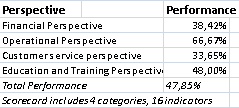

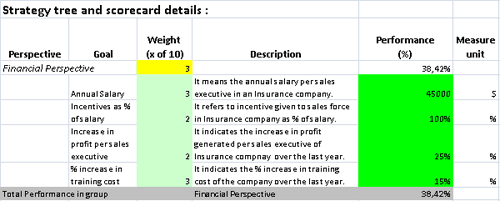

Managing the sales force of a company has often proved to be a cumbersome task to perform and when talked about Insurance companies the tasks even become more difficult. Managing the insurance sales force effectively with the help of KPIs can be of great help. KPIs are the quantifiable measures and would be critical in evaluating the performance of the sales force of an insurance company.KPIs in Insurance Sales Force Management can be broadly grouped in 4 prime perspectives-financial, operational, customer service, and education and training perspective. Financial perspective helps in evaluating the financial aspect of the concept. It comprises of KPIs such as annual salary, incentives as percentage of salary, increase in profit per sales executive, and percentage increase in training cost.Operational perspective would be beneficial in judging the operations of sales force. It consists of KPIs like percentage of renewed policies to the number of policies sold, percentage of policy lapses of missed payments, number of sales targets achieved and percentage decrease in employee turnover.Customer service perspective encompasses KPIs like number of referrals generated from customers, number of customer focused products developed, percentage decrease in customer complaints and percentage of upgraded policies.Education and training perspective talks about the steps taken to improve the efficiency of sales force. KPIs that come under this perspective are number of training sessions, number of brainstorming sessions, number of motivational training sessions and number of quality and feedback initiatives introduced.

Managing the sales force of a company has often proved to be a cumbersome task to perform and when talked about Insurance companies the tasks even become more difficult. Managing the insurance sales force effectively with the help of KPIs can be of great help. KPIs are the quantifiable measures and would be critical in evaluating the performance of the sales force of an insurance company.KPIs in Insurance Sales Force Management can be broadly grouped in 4 prime perspectives-financial, operational, customer service, and education and training perspective. Financial perspective helps in evaluating the financial aspect of the concept. It comprises of KPIs such as annual salary, incentives as percentage of salary, increase in profit per sales executive, and percentage increase in training cost.Operational perspective would be beneficial in judging the operations of sales force. It consists of KPIs like percentage of renewed policies to the number of policies sold, percentage of policy lapses of missed payments, number of sales targets achieved and percentage decrease in employee turnover.Customer service perspective encompasses KPIs like number of referrals generated from customers, number of customer focused products developed, percentage decrease in customer complaints and percentage of upgraded policies.Education and training perspective talks about the steps taken to improve the efficiency of sales force. KPIs that come under this perspective are number of training sessions, number of brainstorming sessions, number of motivational training sessions and number of quality and feedback initiatives introduced.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Being a salesperson in an Insurance sector is a highly tiring task as one not only has to bear the mental stress of 'meeting targets in time' but also has to take care of a large number of dealing sessions, only a fraction of which might fructify.

Looking at the loads of hard-work that goes into materializing the 'financial health', it comes instantly to an Insurance company sales department head that assessment of sales force be done on regular basis. This will help both in 'spotting who is not performing well enough' and 'rewarding the deserving salesperson'.

Balanced Scorecard gives the required focus and potency to accurately measure the growth and progress of Insurance sales department. The principle underlying this is that one can look for useful metrics to count the movements being taken by the sales division. One can utilize the thought of 'cascade' to align scorecards in an even more constructive manner. This in turn, will make it possible to dig into 'individual details' from the organizational levels. Such an act enables quick and correct identification of problem. This will guide the future decisions and conclusions of the department.

This is the actual scorecard with Insurance Sales Dashboard and performance indicators. The performance indicators include: insurance sales force financial perspective annual salary incentives as % of salary increase in profit per sales executive % increase in training cost operational perspective % of renewed policies to the number of policies sold % of policy lapses or missed payments number of sales targets achieved % decrease in employee turnover customer service perspective number of referrals generated from customers number of customer focused products developed % decrease in customer complaints percentage of upgraded policies education and training perspective number of training sessions number of brainstorming sessions number of motivational training sessions number of quality and feedback initiatives introduced.

Download a trial version of Insurance Sales Estimation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."