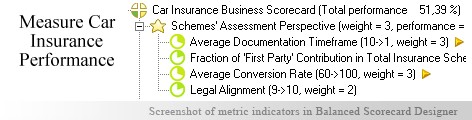

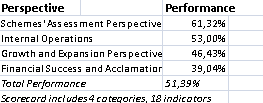

Commitments are to be respected, be it 'reaching on time for a family gathering, meeting an important assignment's deadline' or 'paying the insurance installments in time'. Making collections by getting the latter from clients is the job of Car Insurance Companies. Such organizations in their way of making sufficient monetary collections are faced with several challenges that spin around this concept. However, using BSC (Balanced Scorecard), they can have a way out of their troubles. The perspectives that can serve the purpose are- Schemes Assessment, Internal Operations, Financial Success and acclamation and Growth and Expansion. KPIs that can be put under Schemes Assessment Perspective are Average documentation timeframe, Average conversion rate, Fraction of first party in total insurance schemes and Legal alignment extent. Further, the Internal Operations can be had using indicators- Percentage increase in portfolio, Number of partners and affiliates, Number of insurance schemes offered and Number of fraudulent cases discovered. Financial Success and Acclamation can be calculated via the KPIs like Financial position, Total awards collected, Fraction of income that went into satisfying claims, Forecasted value meeting ratio and total revenue collections.Finally, the Growth and Expansion can be assessed by using the indicators such as- 'Average target Surpassing' ratio, NTU ratio, Number of schemes subscribed scaling and Percentage increase in customized insurance schemes.

Commitments are to be respected, be it 'reaching on time for a family gathering, meeting an important assignment's deadline' or 'paying the insurance installments in time'. Making collections by getting the latter from clients is the job of Car Insurance Companies. Such organizations in their way of making sufficient monetary collections are faced with several challenges that spin around this concept. However, using BSC (Balanced Scorecard), they can have a way out of their troubles. The perspectives that can serve the purpose are- Schemes Assessment, Internal Operations, Financial Success and acclamation and Growth and Expansion. KPIs that can be put under Schemes Assessment Perspective are Average documentation timeframe, Average conversion rate, Fraction of first party in total insurance schemes and Legal alignment extent. Further, the Internal Operations can be had using indicators- Percentage increase in portfolio, Number of partners and affiliates, Number of insurance schemes offered and Number of fraudulent cases discovered. Financial Success and Acclamation can be calculated via the KPIs like Financial position, Total awards collected, Fraction of income that went into satisfying claims, Forecasted value meeting ratio and total revenue collections.Finally, the Growth and Expansion can be assessed by using the indicators such as- 'Average target Surpassing' ratio, NTU ratio, Number of schemes subscribed scaling and Percentage increase in customized insurance schemes.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Auto Insurance deals with offering cover for the plausible losses that a auto owner might have to suffer in future with regard to his vehicle. The insurer is required to make pre-payments on installments basis in return for the agreed sum of money that is paid to the vehicle owner in any of the instances listed in the agreement. The factors on which 'premium charges' to be paid to benefit from this monetary guarantee depend are numerous, some of which are 'gender', 'age' and 'marital status'.

This assurance attained by these documents relieves the vehicle owner of the worry about the liability that might arise in an unfortunate event of traffic accident or theft of vehicle.

The ways in which this aspect is managed varies from nation to nation. For instance, in some nations, it is compulsory to get the vehicle insured for safeguarding it against the possible losses. In some other countries, system for Public Auto Insurance is run so as to tackle this coverage issue in collective manner.

The various complications involved in this business of 'vehicle guarantee' have made it necessary for an Insurance company to arm itself with a car insurance scorecard that lays bare the underlying nitty- gritties to enable the organization catch hold of the 'ailing area' instantly'.

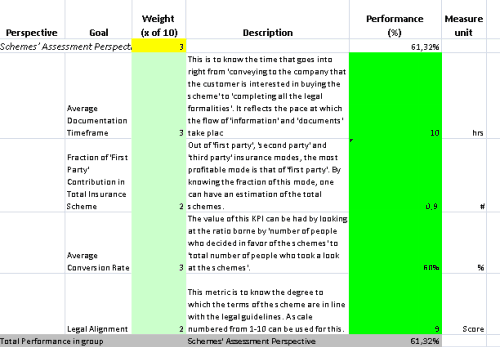

This is the actual scorecard with Car Insurance Indicators and performance indicators. The performance indicators include: schemes assessment perspective, average documentation timeframe, fraction of first party contribution in total insurance scheme, average conversion rate, legal alignment, internal operations, types of insurance schemes offered, percentage increase in the portfolio, number of fraudulent claims made, number of partners and affiliates, being involved in disputes fraction, growth and expansion perspective, number of schemes subscribed scaling, average target surpassing ratio, percentage increase in customized insurance schemes, ntu ratio, financial success and acclamation assessment, total revenue collections, fraction of income that went into satisfying claims, forecasted value meeting ratio, financial position, number of awards collected.

Download a trial version of Car Insurance Estimation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."