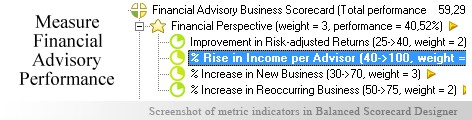

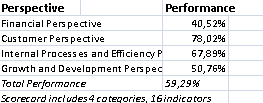

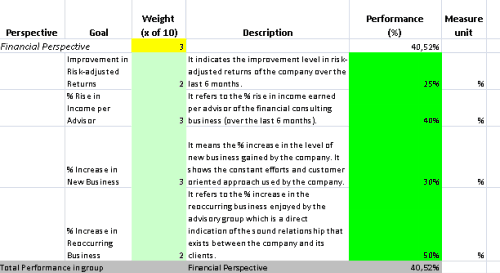

Financial advisors are known for providing specialized investment advice to their clients and charge an appropriate fee or commission for their service which varies from one client to another and the investment transaction level. Financial consulting companies can make use of KPIs arranged in a balanced scorecard to keep a check on all their operations and areas. KPIs for a financial advisory business can be grouped under four major perspectives namely, financial, customer, internal processes and efficiency, and growth and development.Financial Perspective helps in measuring the financial performance of the advisory business in terms of improvement in risk-adjusted returns, % rise in income per advisor, % increase in new business and % increase in reoccurring business.Customer Perspective comprises of KPIs in the form of accuracy level of forecasts, % drop in client attrition rate, customer satisfaction index and transparency level.Internal Processes and Efficiency Perspective consists of KPIs that throws light on the internal processes and the efficiency level of the business. It includes KPIs such as compliance level, number of areas served, improvement in advisory standards and business ethics score.Growth and Development Perspective takes into account KPIs like number of service training programs, % increase in productivity per advisor, turnover rate of financial advisors and number of brain-storming sessions conducted.

Financial advisors are known for providing specialized investment advice to their clients and charge an appropriate fee or commission for their service which varies from one client to another and the investment transaction level. Financial consulting companies can make use of KPIs arranged in a balanced scorecard to keep a check on all their operations and areas. KPIs for a financial advisory business can be grouped under four major perspectives namely, financial, customer, internal processes and efficiency, and growth and development.Financial Perspective helps in measuring the financial performance of the advisory business in terms of improvement in risk-adjusted returns, % rise in income per advisor, % increase in new business and % increase in reoccurring business.Customer Perspective comprises of KPIs in the form of accuracy level of forecasts, % drop in client attrition rate, customer satisfaction index and transparency level.Internal Processes and Efficiency Perspective consists of KPIs that throws light on the internal processes and the efficiency level of the business. It includes KPIs such as compliance level, number of areas served, improvement in advisory standards and business ethics score.Growth and Development Perspective takes into account KPIs like number of service training programs, % increase in productivity per advisor, turnover rate of financial advisors and number of brain-storming sessions conducted.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Financial Advisory is about suggesting people the best possible use of their assets. This involves telling them the options they have for increasing the worth or value and the level to which they can do so. A detailed risk and return profile has to be worked out by the person to make useful and beneficial 'financial' recommendations.

One needs to earn experience and certain qualifications to make a successful financial advisor out of him/her. Related authorities are there to provide certifications in this field to the interested ones and enable them take forward their aim of 'financial advisory'.

Financial advisers make use of the instruments available in the security market to create a suitable mix or portfolio as per the risk (the individual is ready to borne) and return (he/she is looking forward to have).

Basically, the job of financial advisers is to assist in financial planning of individuals and firms. Some of the areas which this 'investment suggestion box' must know about are budgeting, forecasting, asset allocation etc. Coming up with an apt culmination of outlets where the funds can be utilized asks for moving on a measurable route. In other words, a balanced scorecard has all that it takes to help tread the 'financial suggestion' path carefully and accurately. The indicators on this scorecard can be referred to whenever there is a need to make sure that one is on the 'intended track'.

This is the actual scorecard with Financial Advisory Dashboard and performance indicators. The performance indicators include: financial perspective, improvement in risk-adjusted returns, % rise in income per advisor, % increase in new business, % increase in reoccurring business, customer perspective, accuracy level of forecasts, % drop in client attrition rate, customer satisfaction index, transparency level, internal processes and efficiency perspective, compliance level, number of areas served, improvement in advisory standards, business ethics score, growth and development perspective, number of service training programs, % increase in productivity per advisor, turnover rate of financial advisors, number of brain-storming sessions conducted.

Download a trial version of Financial Advisory Estimation Balanced Scorecard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."