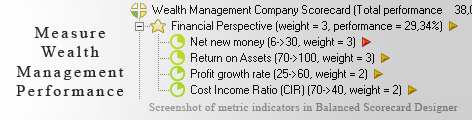

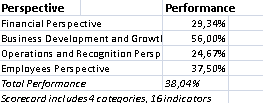

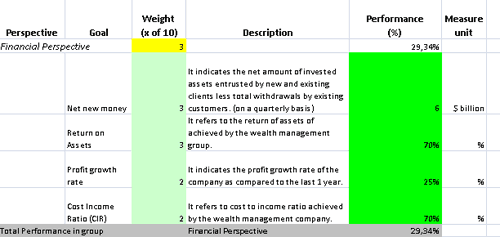

Firms providing wealth management solutions are required to simultaneously take care of a number of internal (operations and recognition) and external (financial and economic disturbances) aspects. This elevates the need for making the 'corporate level strategy' easy to understand such that every stakeholder in the organization can relate to it. One of the ways is to frame it in perspectives, four or five in number. This quantification can be achieved by employing BSC. Financial perspective can be used to obtain an insight into the financial standing of the operations. This can be achieved by quantifying the parameters like- new net money, return on assets, profit growth rate and cost income ratio. Business development and growth perspective can be had with metrics like % new customers acquired, attrition rate of customers, conversion rate and % growth of assets under management. Operations and recognition perspective can be obtained with KPIs such as deposits: AUM (Assets under management), Loans: AUM ratio, number of services offered and number of service awards won. Lastly, employee perspective can be gathered with metrics like employee turnover, % increase in number of relationships per client facing employee, % increase in net new money per client advisor and % increase in revenues per advisor.

Firms providing wealth management solutions are required to simultaneously take care of a number of internal (operations and recognition) and external (financial and economic disturbances) aspects. This elevates the need for making the 'corporate level strategy' easy to understand such that every stakeholder in the organization can relate to it. One of the ways is to frame it in perspectives, four or five in number. This quantification can be achieved by employing BSC. Financial perspective can be used to obtain an insight into the financial standing of the operations. This can be achieved by quantifying the parameters like- new net money, return on assets, profit growth rate and cost income ratio. Business development and growth perspective can be had with metrics like % new customers acquired, attrition rate of customers, conversion rate and % growth of assets under management. Operations and recognition perspective can be obtained with KPIs such as deposits: AUM (Assets under management), Loans: AUM ratio, number of services offered and number of service awards won. Lastly, employee perspective can be gathered with metrics like employee turnover, % increase in number of relationships per client facing employee, % increase in net new money per client advisor and % increase in revenues per advisor.

Read Why do business professionals choose ready-to-use KPIs? to find out the answers to these questions:

Ideally, you need to have a strategy (in a form of a strategy map) before you start thinking about the ways to measure its execution (KPIs). Don't have a strategy map yet? Use free Strategy Map Wizard to create a strategy map for your current business challenges. The wizard will:

The whole process takes on average 6 minutes. Give it a try right now - it's free.

Wealth Management revolves around helping organizations and HNI (High Net worth Individuals) about routes which they can employ to manage wealth. The branches that are utilized include 'retail banking', 'tax professionals', 'estate planning' and 'investment management'.

Wealth managers are expert at advising people about the options they have for 'maximizing wealth'. They can either operate independently or as a money manager who works with the aim of adding to the wealth pool.

The ones working independently utilize make use of their experience in areas like estate planning, risk management etc to come up with different ways in which wealth can be increased.

To beneficially work in the area of wealth management, one can use BSC (Balanced Scorecard) to measure and manage the steps being taken to attain the purpose. However, the word of caution is to select indicators after a pretty thoughtful approach as wrong identification can create more troubles than easing the process.

The way out is to remember the basic of this strategy 'everything that counts is not countable and everything that is countable does not count'.

By making a prudent selection of KPIs (Key Performance Indicators), one can safely transfer the 'monitoring and tracking' task to this instrument.

This is the actual scorecard with Wealth Management Indicators and performance indicators. The performance indicators include: financial perspective, net new money, return on assets, profit growth rate, cost income ratio (cir), business development and growth perspective, % increase in new customers, attrition rate of customers, conversion rate, % growth of assets under management (aum), operations and recognition perspective, deposits to aum ratio, loans to aum ratio, number of services offered, number of service awards won by the wealth management group, employees perspective, employee turnover, % increase in number of relationships per client facing employee, % increase in net new money per client advisor, % increase in revenues per advisor.

Download a trial version of Wealth Management Estimation Balanced Scoreboard or purchase a full version online.

How is this book different from 796 other book titles about KPIs on Amazon?

"Before writing a single line, I formulated some guiding principles, one of them was: "If our clients ask, "How can I find a good KPI for..." - I want this book to provide a perfect answer."